The House of Representatives on Friday passed a $2.2 trillion CCP virus relief bill, two days after the Senate passed the measure.

President Donald Trump, who has repeatedly praised the package, is expected to sign it later today.

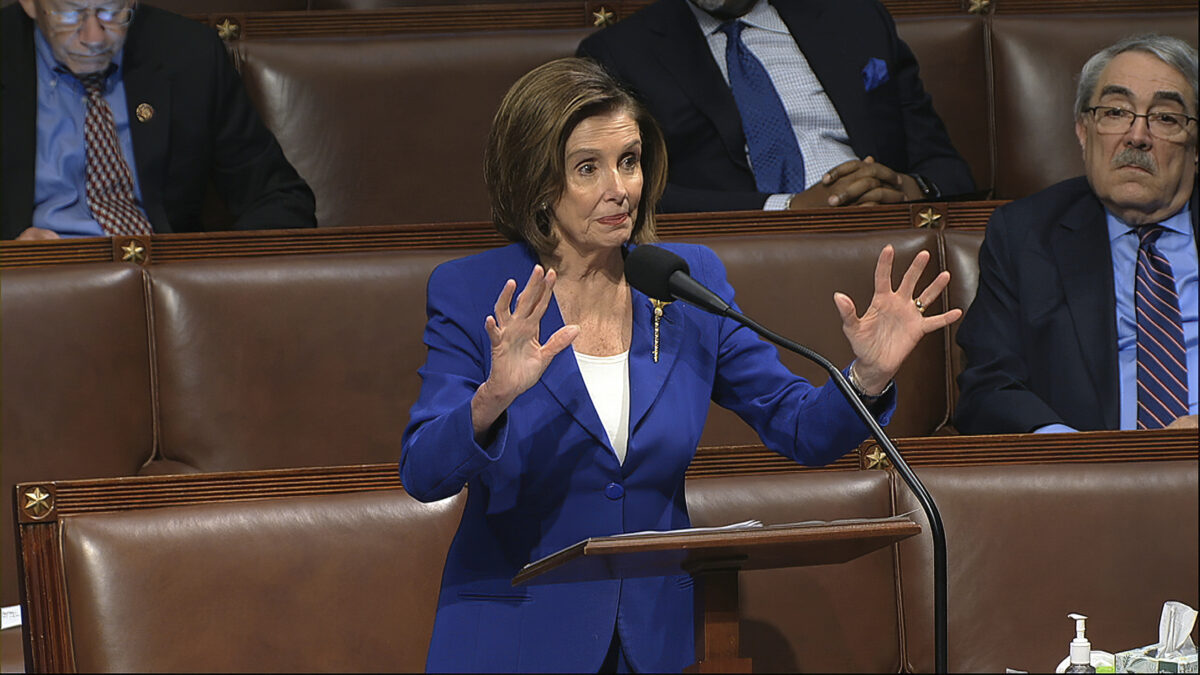

Despite support from both parties, drama unfolded in Washington because Rep. Thomas Massie (R-Ky.) announced his intention to try to force expanded voting on the bill. His call for a recorded vote failed because of insufficient support and a subsequent call for a quorum failed because a majority of lawmakers were already present after members flew in across the country following word of Massies attempt late Thursday.

The package was thus passed on voice vote, with the ayes outnumbering the nays.

Massie said he wanted to make sure “the Republic doesnt die by unanimous consent in an empty chamber.” Many Republicans opposed the move, including Trump, who called Massie a “third rate Grandstander.”

Because the vote wasnt recorded, it wasnt clear who voted which way, but the shout-outs sounded resoundingly in favor of the package. Lawmakers across the chamber applauded after the announcement.

Social distancing measures forced members to spread out in the chamber, with some viewing the proceedings from the visitors gallery. Others werent present, being either in transit to Washington or remaining in their home states.

Both Democratic and Republican leadership said they supported the bill, which originated in the House but underwent changes in the Senate before lawmakers there passed it unanimously on Wednesday night.

Trump on Thursday night told reporters that he was “profoundly grateful that both parties came together to provide relief for American workers and families in this hour of need,” highlighting a number of aspects of the legislation.

The unprecedented $2.2 trillion package that stretches across 880 pages includes one-time payments of $1,200 to any American making less than $75,000 a year and $2,400 to married couples making up to $150,000.

Parents would receive $500 per child.

Individuals or couples making over the limits will still get money, but payments will be reduced by $5 for each $100 over the threshold they make.

The limits are tied to 2019 tax returns or, if theyre not available, 2018 tax returns. People who didnt file returns can use other forms such as a Social Security Benefit Statement.

[contf] [contfnew]