- FTSE 100 index up 28 points

- US adds 1.4mln jobs in August

- American unemployment drops to 8.4%

1.45pm: US adds 1.4mln jobs in August

As mid-afternoon approached, the FTSE 100 has recovered somewhat from its slowdown at lunchtime and was up 28 points at 5,879 shortly before 1.45pm.

Meanwhile, across the Atlantic, the US non-farm payrolls data for August showed during the month that the American economy added 1.4mln jobs during the month, in line with expectations.

However, the bigger story was the unemployment rate, which unexpectedly exceeded expectations by falling to 8.4% in August from 10.2% in July. Analysts had expected a fall to 9.8%, however the lower rate remains at crisis levels.

12.40pm: Wall Street heads for mixed open

In something of a reversal from sessions earlier this week, the main Wall Street indices are expected to start on a mixed note, with the Nasdaq on the back foot following yesterdays tech plunge.

According to spread-betters, the tech-heavy index is expected to start 85 points lower at 11,694, while the Dow Jones Industrial Average is predicted to rise 156 points to 28,444 and the S&P 500 is forecast to climb 8.5 points to 3,463.

All eyes will be on the macro data today with non-farm payroll (NFP) data for August the main event. Investors may be a little nervous after the ADP numbers earlier this week missed expectations by showing only 428,000 private sector jobs were added in the month, undershooting predictions of around 1.17 million.

The NFP data is expected to show 1.4 million US jobs were added in August, below the 1.7 million in July, however, this will still leave the figure around 11 million below the pre-pandemic level. The US unemployment rate is also due and is expected to show a decline in joblessness to 9.8% from 10.2% in July.

“A strong jobs report would add weight to the argument the recovery continues. The latest manufacturing and services updates have been positive, broadly speaking. On the other side of the coin, a disappointing update could put pressure on the Republicans to reach a compromise with the Democrats with regards the stimulus package”, said David Madden at CMC Markets.

Back in London, most of the FTSE 100's gains had evaporated in the early part of the lunchtime session, with the index up just 2 points at 5,853 at 12.40pm.

11.25am: FTSE 100 adds to gains in late-morning

As the morning portion of Fridays session entered its final hour, the FTSE 100 had steadily added to its gains from earlier in the day and was up 37 points at 5,888 at around 11.25am.

The rise comes in spite of a decline in UK construction in August to 54.6 from 58.1 in July amid a slowdown in new orders.

The fragility of the property and construction sectors was on display in the blue-chip fallers list, with Land Securities Group PLC (LON:LAND) down 1.7% at 549.8p in late-morning deals while British Land Company PLC (LON:BLND) fell 1.2% to 354.5p.

However, housebuilder Barratt Developments PLC (LON:BDEV) was at the bottom of the pile, down 2.2% at 527.4p after it and peers Persimmon PLC (LON:PSN) and Taylor Wimpey PLC (LON:TW.) were told by competition regulators that they could be forced to compensate customers after the watchdog found evidence of potential mis-selling of homes with leasehold contracts.

The market also continued to rise despite comments from Michael Saunders, a member of the Bank of Englands nine-member monetary policy committee, which sets interest rates, that more stimulus measures may be needed to boost UK growth and that the strength of the recovery from the pandemic may have been overestimated.

Saunders also added that unless activity and hours worked recovered quickly, unemployment was “likely to rise markedly” when workers were taken off the furlough scheme later this year.

10.10am: A setback for the construction sector's recovery

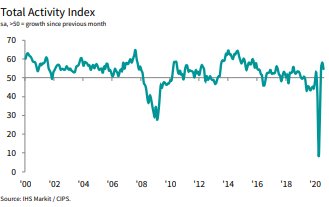

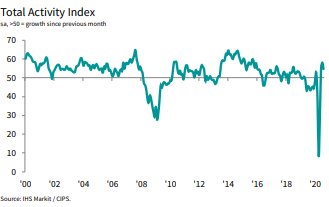

The IHS Markit/CIPS UK Construction Total Activity Index fell to 54.6 in August from 58.1 in July.

A reading above 50 indicates an expansion in output.

IHS Markit, which compiles the survey, said respondents mostly suggested that a lack of new work to replace completed contracts had acted as a brake on the speed of expansion.

"The momentum in the sectors recovery hit a bump in the road in August with a sudden slowdown in output growth and tender opportunities, while employment trends remained the most fragile in a decade,” said Duncan Brock, the group director at the Chartered Institute of Procurement & Supply (CIPS).

"This stalled progress was not a surprise given the warning signs last month that any hard-won progress could start to fizzle out. As new order gains slowed across all sectors, continuing COVID-19 anxiety amongst clients meant many projects still remained on ice; though residential building remained the strongest, it too was showing signs of strain,” he added.

Tim Moore, the economics director at IHS Markit, said the latest data signalled a setback for the UK construction sector.

“House building remained the best performing area of construction activity, with strong growth helping to offset some of the weakness seen in commercial work and civil engineering activity. The main reason for the slowdown in total construction output growth was a reduced degree of catch-up on delayed projects and subsequent shortages of new work to replace completed contracts in August,” he revealed.

“Another month of widespread job shedding highlighted the ongoing difficulties faced by UK construction companies, with order books often depleted due to a slump in demand from sectors of the economy that have experienced the greatest impact from the pandemic.

“More positively for the employment outlook, business expectations climbed to a six-month high in August as construction firms turned their hopes towards a boost from major infrastructure work and reorienting their sales focus on new areas of growth in the coming 12 months,” he added.

The FTSE 100 was up 26 points (0.4%) at 5,877.

9.35am: Blue-chips advance despite sterling's rally

UK investors continue to behave in contrary fashion, with blue-chips on the up despite yesterdays US sell-off and a strengthening pound.

The FTSE 100 is up 35 points (0.6%) at 5,886, even with the pound up by a fifth of a cent at US$1.3298.

“The tech-inspired sell-off in the States overnight was mainly the result of a bout of healthy profit-taking,” opined Richard Hunter at interactive investor.

“Some disappointment following the ADP report earlier in the week was compounded by an uncomfortably high jobless claims number, while the service sector rebound also slowed in August. Even so, the fact that there was no particular rush to haven assets suggests that some sort of rebalancing was overdue,” he continued.

“If the US economic recovery is running into some resistance, the non-farm payrolls figure later today should provide some further colour. The consensus is that some 1.3 million new jobs will be confirmed, as compared to the figure of 1.8 million reported for July, which itself was ahead of expectations. Should consensus not be met, it is likely that calls for further fiscal stimulus from the US government will intensify, although any such stimulus is now becoming politically charged as the Presidential election campaign gathers pace,” Hunter said.

One of the stocks still suffering collateral damage from the tech sell-off is Scottish Mortgage Investment Trust PLC (LON:SMT), which is heavily invested in many US tech titans (and still sitting on eye-popping profits even after yesterdays correction). The shares were the worst performers on the Footsie, down 1.8% at 891.5p.

READ Teslas second largest shareholder takes some profits[hhmc]

Property companies are also out of favour, with Land Securities Group PLC (LON:LAND) down 1.3% at 551.9p and Britsh Land Company PLC (LON:BLND) 1.2% lower at 354.5p.

Three housebuilding companies have been sent to the naughty step by the Competition & Markets Authority for so-called “fleeceholding” practices but Berekely Group Holdings PLC (LON:BKG) is not one of them; its shares are up 1.2% at 4,706p after it reiterated its guidance for £500mln in pre-tax profit for the full year.

READ Three FTSE 100 builders get wrists slapped by watchdog over unfair leasehold terms[hhmc]

“Berkeley has continued the run of optimistic news from housebuilders. Pricing has remained robust, which lines up with just about every other piece of news weve had, although its particularly reassuring given Berkeleys higher-end London properties. The question is what happens going forward, and Berkeley is confident on that score. While other builders are being more cautious Berkeley is giving full-year projections for both profits and dividends,” commented William Ryder at Hargreaves Lansdown.

“Berkeley offers something a bit different to the other housebuilders, which is reflected in managements confidence and the groups valuation. Assuming we can avoid further disruption or a sustained recession the group looks well placed going forwards,” he added.

This is a really big deal. REALLY big. For leaseholders, housebuilders… for the future of the industry and, quite simply, the way we build homes for people. As ever, expert analysis and explanation by @PeacheyK https://t.co/cn9JjLqzz3

— Dan Whitworth (@bbcdanw) September 4, 2020

8.40am: Positive end to week at open

Traders completely ignored the carnage overnight on the other side of the Atlantic with the FTSE 100 nudging modestly higher on Friday.

The UK blue-chip index rose 17 points to 5,867.86 early on.

The long-due correction on Wall Street wiped almost 600 points, or 6% off the tech-led Nasdaq Composite, while the Dow Jones Industrials Average tanked 800 points or 2.8%.

“Recently, the NASDAQ 100 has powered ahead as big-name companies like Apple, Netflix, Amazon, Alphabet, Microsoft and Tesla have been in extremely high demand,” said David Madden of CMC Markets.

“There has been talk of gross overvaluations for some time, and yesterday there was a big sell-off in the stocks. Panic selling set in and equities across the board suffered as a result.”

In London, the shares of Barratt Developments (LON:BDEV), Persimmon (LON:PSN) and Taylor Wimpey (LON:TW.) were marked down at the open.

This followed the revelation that they could be forced to compensate customers by the UK competition watchdog after it found evidence of potential mis-selling of homes with leasehold contracts.

Barratt was the biggest loser as its shares fell 3.4%.

Aero-engineer Melrose (LON:MRO) continued its results-driven bounce to top the Footsie with a 2.2% gain, while jet engine maker Rolls Royce wasnt too far behind with a 2.1% rise.

There were still bargain hunters in for ITV (LON:ITV) in spite of its impending exit from the blue-chip index. Shares in the broadcaster rose 1.5%.

Proactive news headlines:

Filta Group Holdings PLC (LON:FLTA) said it has secured exclusive rights to a new broad-spectrum disinfectant that can be deployed without the need to evacuate a room or to require extensive use of personal protective equipment helping in the fight against the spread of coronavirus (COVID-19). This makes it an ideal option for customers in a wide range of sectors from office blocks and schools through to commercial kitchens and restaurants, the company added. The group has been given access to hypochlorous acid-based product by NTH Solutions, the support services arm of North Tees and Hartlepool NHS Trust.

[email protected] Capital PLC (LON:SYME) said it has signed a formal business alliance with Epic SIM for inventory funding and client company origination. Epic is a fintech platform for working capital solutions, enabling small and medium-sized enterprises (SMEs) to present their development projects, including an inventory monetisation service, to a selected audience of qualified investors. [email protected] said the alliance will create a new sales channel for the group, including client company origination, sourced as companies come to the Epic fintech platform, and inventory funding.

Scotgold Resources Limited (LON:SGZ) has said construction and development activities at the Cononish gold and silver project are progressing well, with the first gold pour from the Scottish mine expected before the end of November. The company said underground development at Cononish has benefited from the arrival on site of the previously announced standby ST2G scoop tram while the first of two new T1D drill rigs is currently in transit. Plant construction is now focused on the building structure, to be followed by the installation and connections of pumps, drives, piping and electrics and ultimately commissioning, the company said. Scotgold also revealed that it has beefed up its geoscience team with two appointments.

United Oil & Gas PLC (LON:UOG) has expanded its footprint in the North Sea, picking up two new licence blocks in the UKs 32nd Licensing Round. The new acreage, Blocks 15/18e and 15/19c, contain three discoveries and the Dunvegan prospect. They are located adjacent to Uniteds existing acreage, and the Zeta prospect. Altogether the new acreage spans 225 square kilometres, in the vicinity of the substantial Piper, MacCulloch and Claymore oil fields. "We are delighted with these awards which, based on extensive technical work carried out over the available acreage ahead of the application, were our primary focus for the 32nd round,” Jonathan Leather, United O&G's chief operating officer said in a statement.

World High Life PLC (LON:LIFE) has said that in accordance with its investment strategy and building on momentum from its Love Hemp subsidiary, it is now “actively considering” investment targets in the medicinal cannabis space. The company said potential targets include new technologies, pharmaceuticals, synthetic cannabinoids, cannabidiol (CBD) and hemp with potential for wide applications in multiple jurisdictions. Within this scope, World High Life said it intends to invest in and scale “innovative, early stage” uses of cannabinoids which have existing approvals in place to benefit patients and users.

Caledonia Mining Corporation PLC (LON:CMCL) has raised US$13mln via a share sale by Cantor Fitzgerald. Proceeds of the share sale are earmarked for investment in the construction of a solar power plant to supply electricity to the Blanket gold mine in Zimbabwe. The company said it had raised the funds via its "at the market" (ATM) equity sale agreement, issuing some 597.9mln shares. Caledonia plans to construct a solar plant to handle all of the Blanket mines baseload electricity demand during daylight hours and about 27% of Blankets total daily electricity demand.

Alien Metals Ltd (LON:UFO) is to raise £1.25mln by issuing shares at 0.55p each from a share placing and subscription with the proceeds earmarked for a range of exploration activities across the company's portfolio in Mexico and Western Australia. Bill Brodie Good, the group's new chief executive officer and technical director of Alien Metals, said the funds would, specifically, be used to fast-track activities at the high-grade Elizabeth Hill silver project, through a mixture of surface sampling and trenching programmes. “With the strengthened silver price and strong demand outlook, the company is well placed with a portfolio of high-grade projects that demand further exploration and development,” he added in a statement.

i3 Energy PLC (Read More – Source

[contf] [contfnew]